Amid the transition to blended and online learning, exclusive AMBA & BGA research shows that Business Schools received more applications across an increased number of MBM programmes in 2020, although regional experiences for the format did vary

AMBA-accredited Business Schools received a larger volume of applications for their master’s in business management (MBM) programmes, on average, as many upped the number of programmes on offer between 2019 and 2020, according to new and exclusive data from AMBA & BGA.

Changes to admissions numbers, 2019-20

Although the number of applications to individual MBM programmes fell by 7% between 2019 and 2020, there was a 5% increase in the number of MBM applications per Business School, indicating that larger volumes of applications were spread across a greater number of programmes. Indeed, the number of MBM programmes offered by responding Business Schools worldwide in 2020 was 13% higher than in 2019. This increase might help to explain why, for example, applications per MBM programme available among Business Schools in India were down by 12%, yet the total number of applications received by each School in the south Asian country were up by an average of 4%.

Globally, the uptick in programme options appears to have generated a greater number of applications from prospective students in a year marked by the impact of Covid-19, although these changes were more pronounced in some regions than others. In Europe (excluding the UK), for example, MBM applications per School were up 17% in 2020 and, among Business Schools in the UK, the rise was 23%.

Regardless of the number of programmes on offer, the growing ranks of MBM students worldwide are demonstrated by the increase in the number of those enrolling onto programmes in 2020. Not only did enrolments per Business School (which encompasses their increase in programme number) rise – by 21% worldwide – but so too did the average number of students that enrolled on each individual programme, by 8%. MBM enrolments per programme were up by a regional high of 26% in Europe (excluding the UK).

Third instalment of Business Impact’s MBM market analysis

This is Business Impact’s third report on the admissions landscape for master’s in management (MBM) programmes worldwide. The BGA publication’s inaugural investigation into data for international MBM applications and enrolments was released in 2020 and focused on the scale of demand for the MBM format in India. Released earlier this year, the report’s second iteration considered key demographics of those applying and enrolling onto MBM programmes – namely, the proportional splits between male and female students and between domestic and international students.

This latest edition is focused on year-on-year variations in data, together with a deep dive into case studies of two key providers of the MBM format, France and the UK, to the left of this column. All findings are based on AMBA & BGA’s exclusive pool of data relating to admissions to 149 MBM programmes in the calendar year of 2019, rising to 168 MBM programmes in the calendar year of 2020, on offer among 49 Business Schools worldwide – all of which are accredited by BGA’s sister organisation, the Association of MBAs (AMBA).

Tracking the impact of Covid-19 on teaching methods

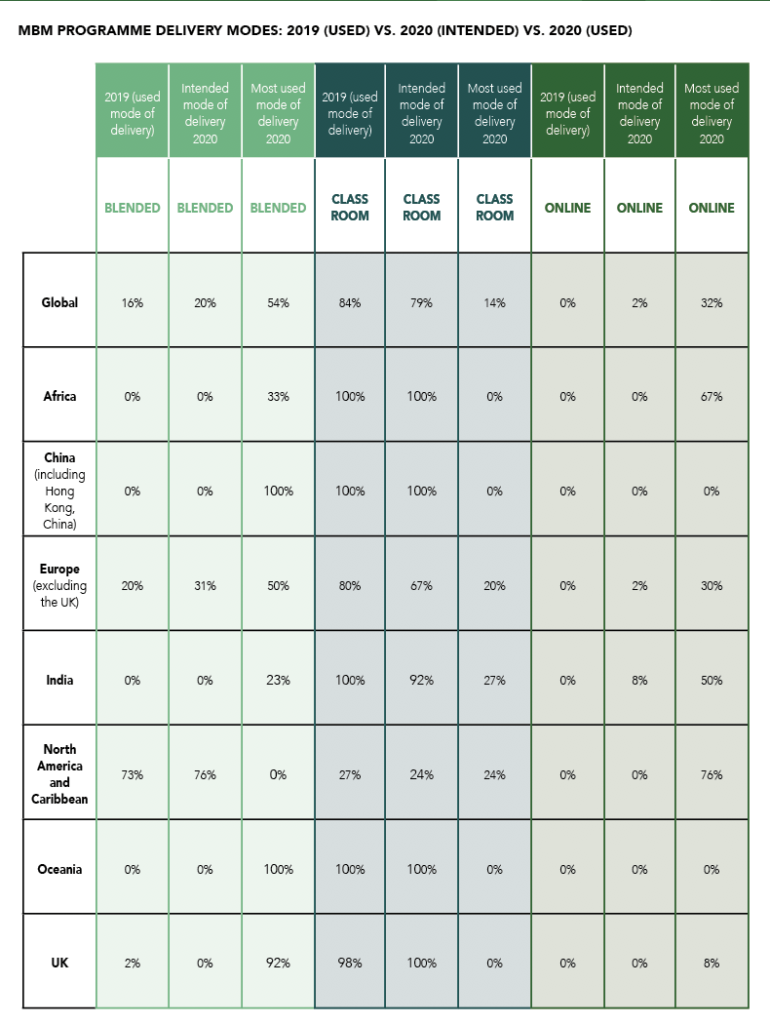

We know that many Schools have been forced to pivot on their delivery of programmes due to Covid-19, so this year’s data template asked for Schools’ ‘most used mode of delivery’ as well as their ‘intended mode of delivery’ with a view to determining the difference between theory and practice.

Comparing, firstly, how programmes were taught in 2019 to how they were intended to be taught in 2020, already indicates a slight global trend for programmes to be taught using blended or online modes of delivery, even before the disruption of Covid-19 has been considered. If all programmes globally had been taught the way they had been intended to in 2020, the classroom mode of teaching would have decreased in usage by five percentage points between 2019 and 2020. Yet, classroom teaching was the most used mode of delivery on only 14% of programmes globally in 2020, down from 84% in 2019. The majority of MBM programmes turned to a blended format (54%), with a further 32% of programmes using online delivery for the most part. This shift shows the very real impact that the Covid-19 pandemic has had on global teaching methods.

Acceptance and yield

Acceptance rates (the percentage of applicants who were given an offer by a Business School) varied significantly across regions, but the global average was 6% in 2020. MBM programmes in India had the lowest acceptance rate, on average, with only 1% of those who applied being accepted onto a programme. Elsewhere, acceptance rates were significantly higher, for example 37% among programmes in Europe (excluding the UK) and 48% in the UK.

Yield (the percentage of students who enrol onto programmes in Business Schools after being offered a place) also varied significantly by region. While the global average was 32%, the UK’s yield rate was 18% in 2020, compared to 41% among responding Business Schools in Europe (excluding the UK). This suggests that applicants to MBM programmes the UK were more likely to apply for more than one Business School and were left choosing between those from which they received an offer, whereas those applying to programmes in Europe (excluding the UK) were more likely to have their eyes firmly fixed on one Business School.

Diversity in MBM admissions

Gender

Globally, the proportion of female applicants to MBM programmes in 2020 was 37%, an increase of one percentage point from 2019. Enrolments, however, remained closer to an equal gender balance – 47% of enrolled students in 2020 were female and this worldwide figure is unchanged from its equivalent in 2019.

On a global level, there was no change to the global proportion of female enrolees between 2019 and 2020, meaning that female students continued to represent the majority of enrolees in many areas of the world. In China (including Hong Kong, China) women made up 62% of enrolled students, in Africa it was 60%, Oceania 53% and the UK, 51%.

Business Schools in India had the lowest proportion of female enrolees in its master’s in business management programmes, at an average of 37% across its cohorts in 2020. However, this represents an improvement of three percentage points on the equivalent figure from 2019.

International students

When looking at the global picture, students who applied and enrolled onto MBM programmes in 2020 appear to come overwhelmingly from the domestic market. Among applicants, 96% were domestic, although this drops to 68% among enrolees. In each case, the figures represent a one percentage point decrease in the proportion of international students from the last year.

Yet the global picture hides significant regional variations. While most regions did have a majority of domestic applicants to its MBM programmes, North America and the Caribbean and the UK provide two notable exceptions to this rule, with only 9% and 3%, respectively, of applicants and 15% and 12%, respectively, of enrolees coming from the domestic base of the Business Schools in these regions.

Two European business education stalwarts: MBM admissions case study

France and the UK are two of the world’s biggest markets for business education and the options for studying a master’s in business management (MBM) degree at one of their leading Business Schools are often high on the list of many prospective students – both domestic and international.

They are also countries with significant numbers of AMBA-accredited Business Schools. This case study compares admissions data from 98 MBM programmes on offer among 29 Business Schools in France and the UK which responded to AMBA’s application and enrolment survey for the calendar year of 2020.

France

Across 44 programmes, Business Schools in France received an average of 3,621 applications per programme in 2020 and ultimately enrolled an average of 453 students. The acceptance rate (the number of applicants who were offered a place at the Business School) was 43%. The yield (the proportion of those who chose to enrol after being were offered a place) was 29%.

The vast majority (92%) of MBM programmes in France were intended to be taught in the classroom, with only 5% intended to be taught using a blended approach and 1% intended as being fully online. As the events of 2020 unfolded, the proportion of programmes that were actually taught in the classroom dropped to 33%, while blended and fully online teaching rose to 27% and 39%, respectively.

Applicants to MBM programmes in France were a 50/50 split between men and women. Among those enrolling, 49% were female on average.

MBM applications to Business Schools in France came largely from domestic prospects in 2020, with only 17% stemming from international prospects. However, this proportion rises to 23% among enrolled students.

The UK

There were, on average, 800 applications and 68 enrolled students per programme across 54 MBM programmes in the UK in 2020. The average acceptance rate in the UK was 48%, while the average yield was 18%.

The difference between pre- and post-Covid-19 teaching modes is stark. All programmes (100%) included in this data analysis were intended to be taught in the classroom in 2020, yet none ended up being delivered this way. Instead, 89% were taught using a blended mode and 11% were fully online.

There were, on average, more female applicants to MBM programmes in the UK than male – 57% of applications came from women. However, the average proportion of female students levels out to 51% when looking at enrolled students.

Nearly all (97%) applications to MBM programmes in the UK came from international prospects in 2020. Only 3% of applicants were based in the UK itself. When looking at enrolled cohorts, the picture shifts slightly, with 88% defined as international students, and 12% defined as domestic students.

Key contrasts between France and the UK

As can be seen from the above, there are some significant differences when comparing MBM admissions in France and the UK, based on Business Schools’ experiences in 2020.

- More applications per programme in France (3,621 vs. 800 in the UK).

- Smaller class sizes in the UK (68 enrolled students per programme vs. 453 in France). This is, in part, driven by France’s prestigious Grande École programmes which have high numbers of students.

- Higher yield in France (29% vs. 18% in the UK). This suggests that applicants to UK Business Schools are more likely to have applied to multiple institutions.

- Far higher proportion of international students in the UK (88% of enrolled students vs. 23% in France).

Methodology

The AMBA & BGA Application and Enrolment Report 2021 outlines the current state of the world’s MBA market. As part of the data compiled for the report, 61 AMBA-accredited Business Schools also provided data on their portfolio of master’s in business management programmes (commonly known as MBMs or MiMs).

These generalist, postgraduate, and predominantly pre-experience, degrees are most often designed to provide a thorough grounding in the theoretical fundamentals of management, accompanied by substantial practical input. As such, it typically provides a foundation for individuals starting a career in management and has been identified as a particular area of interest for members of the Business Graduates Association (BGA), which aims to ensure graduates of all levels of business education commence their careers with a firm understanding and appreciation of the principles of responsible management, positive impact and lifelong learning.

Of the 61 Schools who provided data on their master’s programmes for the calendar year of 2020, 49 also completed last year’s study in which they supplied data for 2019, allowing figures to be compared directly between the same Schools, year on year. This analysis covered 168 programmes in 2020, which rose from 149 programmes in 2019. This like-for-like analysis is the most accurate measurement of changes in the AMBA & BGA network from year to year, as it compares an identical set of Schools that is not skewed by changes in the profile or participation of AMBA-accredited Business Schools.

MBM programmes analysed in the like-for-like proportion of this report were delivered at Business Schools based in the following locations: Europe (excluding the UK) (38%); the UK (31%); India (15%); China (including Hong Kong, China) (1%); North America and the Caribbean (10%); Oceania (1%); and Africa (6%).

This article is taken from Business Impact’s print magazine (edition: November 2021-January 2022).

Main image credit: Tom Hauk on Unsplash